Your trusted and growth partner.

Who We Are

We are a non-bank financial services company offering Loans, Guarantees, and Insurance products.

Unlock Your Financial Freedom With FLORIR CAPITAL Logbook Loans.

LOGBOOK LOANS

Looking for a Quick loan? Choose Florir Access Capital Limited for reliable and flexible Logbook Loans in Kenya. Utilize your vehicle as collateral to access affordable interest rates in urgent financial situations.

Logbook Loans are perfect for those with poor credit or limited credit history, offering low rates, flexible repayments, and a secure, confidential process. Experience the advantages of Logbook Loans today.

The Steps of

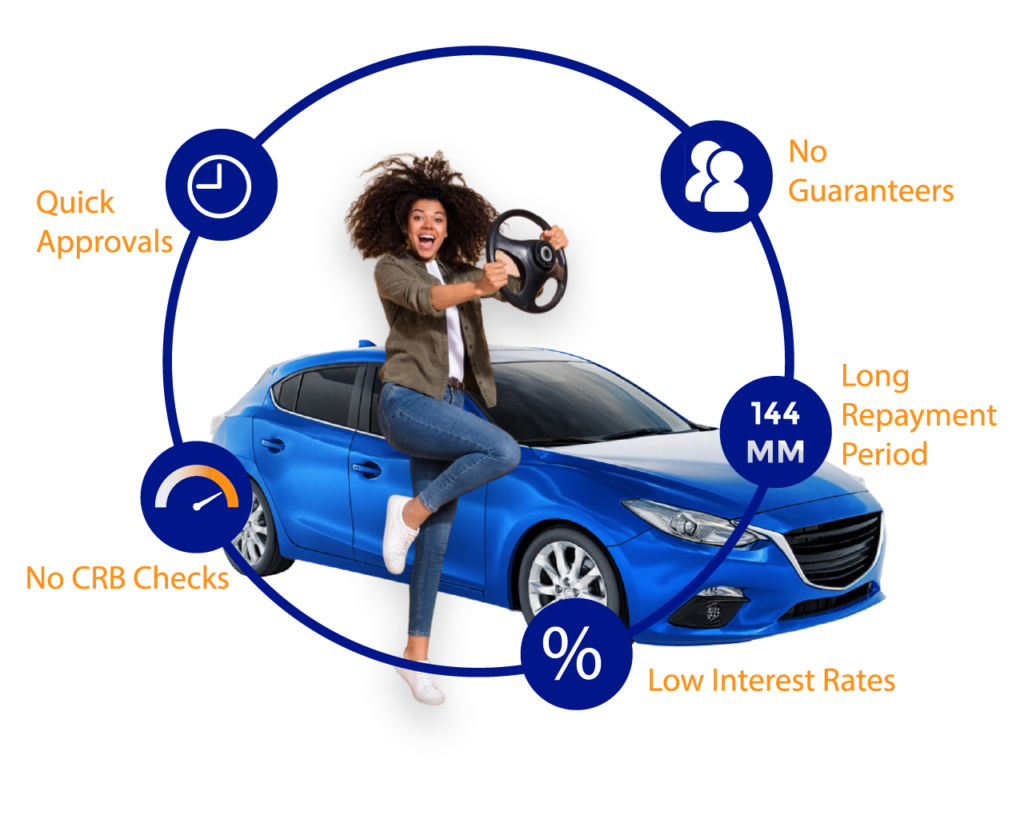

Benefits Of Logbook Loans

Experience Hassle-Free Financial Solutions

We understand that every financial situation is unique, and our goal is to provide personalized service that meets your needs. Here’s why choosing our logbook loan service is the right choice for you:

Quick & Hassle-Free Application Process

Logbook loans are designed to provide you with instant loans, ensuring you can address your financial needs without delay.

No Credit Check Required

As your vehicle serves as collateral, logbook loans do not require a credit check, making them ideal for those who might not qualify for traditional loans.

Access To Competitive Interest Rates

As a secured loan, logbook loans offer competitive interest rates compared to unsecured loans.

Retain Possession Of Your Vehicle

Even as collateral for a logbook loan, you can still use your vehicle during the loan period, ensuring no disruption to your daily transportation needs.

Flexible Repayment Plans

We allows you to choose a repayment plan that aligns with your budget and financial goals. With terms extending up to 24 months, you can tailor the repayment schedule to best suit your needs.

Confidential & Secure Service

Your privacy is our top priority, and our logbook loan service ensures your personal information and financial transactions are handled securely.

Commitment To Customer Satisfaction

Our user-friendly online platform simplifies the logbook loan application process. Fill out the online form with personal and vehicle logbook details. Our experts will review and contact you within 30 minutes to discuss your loan options.

Transparent & Straight-Forward Loan Terms

We believe in complete transparency when it comes to our logbook loans. Our loan contract terms are clearly outlined, with no hidden fees or charges, so you know exactly what to expect from the start.

Professional & Experienced Team

Our team of experts possesses extensive experience in the financial industry. We are dedicated to helping you navigate the world of logbook loans, providing expert advice and support at every step of the process.

Logbook Loan Application Process

Our user-friendly online platform enables you to apply for a logbook loan in just a few simple steps. Begin by filling out our online application form, providing accurate personal and motor vehicle logbook information. Once submitted, our team of experts will review your application and contact you to discuss your loan options within 30 minutes of application. Here are 5 good reasons why Mwannachi Credit offers the best logbook loans in Kenya.

- No guaranteers needed.

- We offer long repayment period - 24 months.

- Low interest rates.

- No CRB Checks.

- Quick Approvals - Within 15 minutes.

Our Products

What We Do

What you can't predict, insure. Protect what matters most to you

Professional Indemnity

Public Liability

Life Insurance

Medical Insurance

Motor Insurance

Domestic Insurance

What you can't predict, insure. Protect what matters most to you

Advance Payment Guarantees

Performance Bonds

Bid Bonds

Cashless Bid Bond

Cashless Performance Bond

Required Documents & Vehicle Information

Required Documents & Vehicle Information

- Valid government-issued National Identity Card

- Passport photo

- KRA Pin

- Proof of income – 6 months bank statements

- Proof of residence

- Original logbook or registration document

- Proof of Comprehensive insurance cover

The Steps of

Getting Financing

Provide your details and apply for an amount ranging from Kshs. 10,000 to Kshs. 5,000,000.

The Credit Department reviews your request and verifies your documents.

On approval, we disburse the amount to you within the shortest time possible.

After the grace period has elapsed, you can conveniently make your repayment using our Paybill.

Our

Loan Products